The WA State Government has recently released and updated assistance packages for those businesses impacted by past Covid-19 restrictions. Below is a summary of the support packages available.

If you feel that you may be eligible for any of the below grants, please reach out and we can help determining your eligibility and supporting you with the application process.

1) Small Business Hardship Grants Two tiers of grants are now available to businesses that experienced a decrease in turnover of over 30% for a consecutive two-week period between 1 January and 30 April 2022. Eligibility conditions are as follows:

Have a valid and active ABN

Have an annual turnover of more than $50,000 excluding GST

Australia-wide payroll of less than $4m

Demonstrate a reduction in revenue of at least 30% for any 2 week consecutive period between 1 January 2022 and 30 April 2022 compared to the equivalent period in 2021

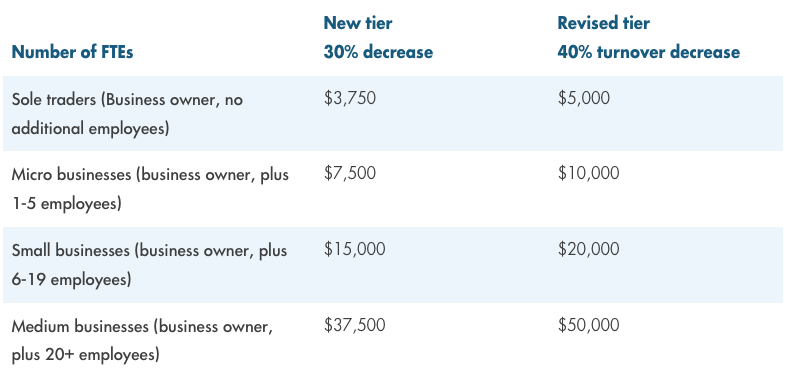

Payments will be depend on the reduction in turnover and the number of Full time Equivalent (FTE) employees:

2) Small Business Assistance Grant - December 2021

A maximum grant of $12,500 for employing businesses and $4,400 for non-employing businesses operating in either the hospitality, music events or arts sectors and specific to the trading period between 23 December 2021 and 4 January 2022. Eligibility conditions are as follows:

Have a valid and active ABN

Have an annual turnover of more than $50,000 excluding GST

Australia-wide payroll of less than $4m

Be located within the Perth, Rottnest or Peel regions

Demonstrate a reduction in turnover of at least 30% compared to the same period the prior year that is directly linked to the restricted trading conditions.

3) Small Business Rental Relief Package

a) Tenant Relief Scheme

Small business tenants can apply for rental relief grants of $3,000. Eligibility conditions are as follows:

Have a valid and active ABN

Have an annual turnover of more than $50,000 excluding GST

Australia-wide payroll of less than $4m

Demonstrate a reduction in revenue of at least 30% for any 4 week consecutive period between 1 January 2022 and 30 April 2022 compared to the equivalent period in 2021

Provide proof of tenancy in WA

b) Landlord Rent Relief Scheme

Landlords who have a tenancy agreement with a small business owner who was found eligible for the Tenant Rent Relief Scheme payment of $3,000, and voluntarily matched (provided the equivalent payment, credit or waiver) the $3,000 for their tenant, may apply for the $1,500 incentive payment.

4) Payroll Tax Waiver

Larger hospitality businesses that have a payroll of between $4 million and $20 million will be eligible for a three-month payroll tax waiver if they have experienced a reduction in revenue of at least 40% over any 4 week consecutive period between 1 January 2022 and 30 April 2022 compared to the equivalent period in 2021.

5) Other initiatives

Hospitality and event grants available include:

Alfresco Support Package

Waiver of Liquor Licence Fees

Nightclub Assistance Program

Independent Performing Arts, Theatres and Cinemas Assistance Program

Event Suppliers Support Program

City Events Grants Program

For further information on these packages and to determine if you could be eligible, please get in touch. If you found this information useful, please share it with your friends and family. Warm Regards,

Veronika Komarenko Optimize Business Advisory

Comments